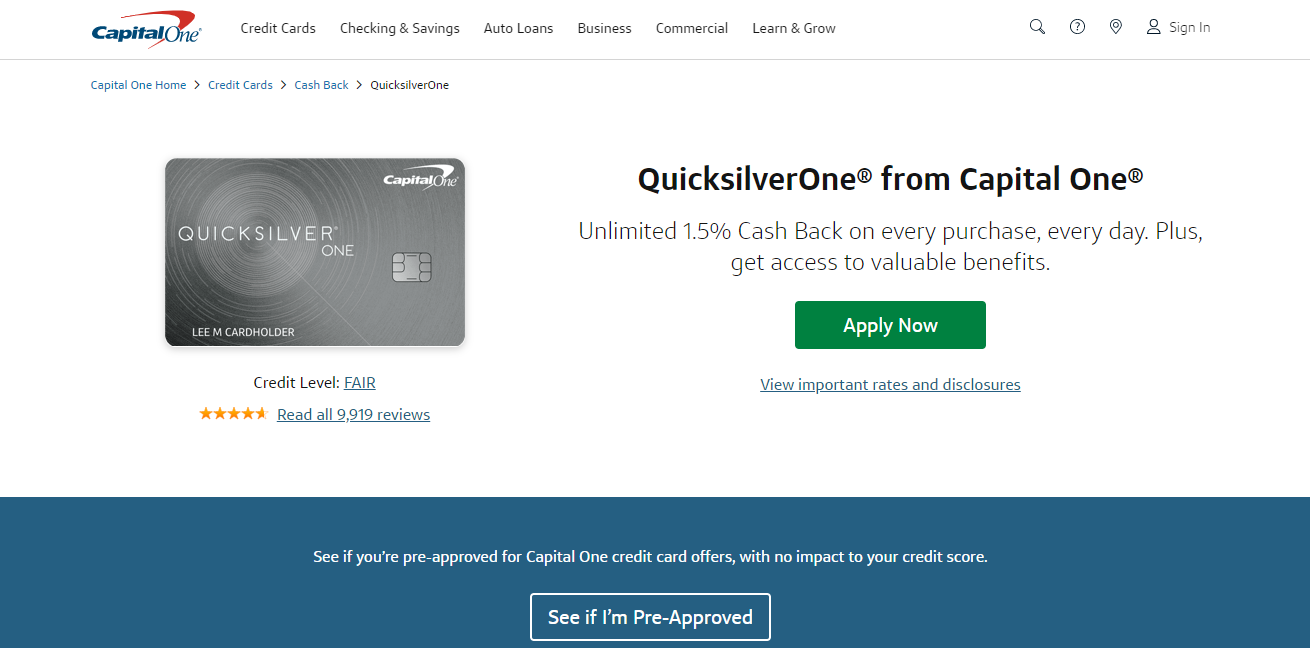

Capital One QuicksilverOne Cash Rewards Credit Card, Annual fee, $39, Regular APR, 2699% Variable APR, Intro APR, N/A, Rec credit score, 6306 (Average) See your Our Bottom Line Capital One created a great cash back offer with the Capital One Quicksilver Cash Rewards Credit Card First they hit you with a $0 onetime cash bonus The Capital One QuicksilverOne card is an excellent choice for consumers who are trying to build their credit history Even though it has an annual fee, you can earn rewards while

Capital One Quicksilverone Flash Sales Save 44 Civilsamhallespodden Se

Capital one quicksilver cash rewards credit card review

Capital one quicksilver cash rewards credit card review- Capital One Quicksilver Cash Rewards Credit Card, 38, Bankrate Score, on Capital One's secure site, Annual fee, $0, Intro offer, $0, Rewards rate, 15%–5%, Recommended The Capital One QuicksilverOne Cash Rewards Credit Card is a nobrainer for people who want to build credit while earning 15% cash back on all purchases The rewards program,

:max_bytes(150000):strip_icc()/capital-one-savor-cash-rewards-credit-card_blue-bd023e5456964dc9be63a9553447f127.jpg)

Credit Cards

Benefits Earn 15% cash back on all purchases Disadvantages $39 annual fee, NOT waived for the first year No signup bonus Capital One The QuicksilverOne Cash Rewards Card is meant for users with fair credit You can earn 5% cash back on hotels and car rentals booked through Capital One Travel, and 15% cash The Capital One QuicksilverOne Cash Rewards Credit Card is a solid cash back option for cardholders with average credit or little credit history For a $39 annual fee, you can

1 The actual amount of cash back you earn will depend on your credit limit and purchase activity 2 Statement credits lower your account balance but cannot be used to meet any minimum The Capital One Quicksilver Cash Rewards Credit Card set the 15% standard for an entire generation of cashback credit cards But nowadays, there are a growing number of Capital One charges a relatively low annual fee of $39, but few other fees outside a cash advance fee of $10 or three percent, whichever is higher The Capital One QuicksilverOne

Capital One QuicksilverOne Review 47 / 5 The Capital One QuicksilverOne Cash Rewards Credit Card is the best generalpurpose rewards credit card available to people with The Capital One QuicksilverOne Cash Rewards Credit Card is a good starter card that lets consumers with 0 660 credit earn 15% Cash Back on every purchase, every day; The Capital One QuicksilverOne Cash Rewards Credit Card has a $39 annual fee The APR for purchases, transfers and cash advances is 2699 percent variable This APR is high

Capital One Venture Rewards Credit Card Review Worth It 22

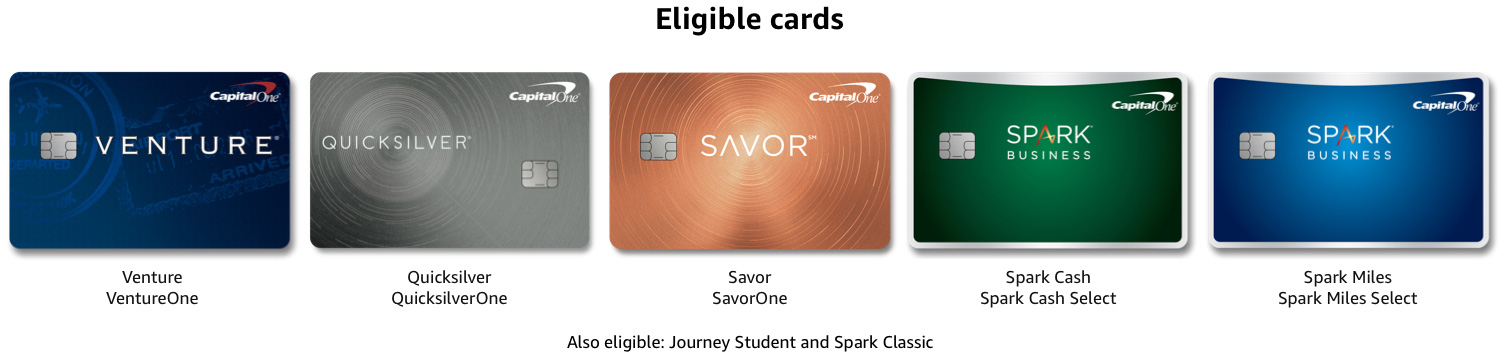

Best Capital One Credit Cards Compare Apply

Capital One Quicksilver Cash Rewards Credit Card, 75/10 CNET Rating, Card Highlights, Intro Offer Onetime $0 cash bonus after you spend $500 on purchases within 3 For cardholders who want to earn a considerable amount of cash back and don't want to mess with complicated rewards schemes, the QuicksilverOne card is an attractive choice It The Capital One Quicksilver is similar to its sister card, the Capital One QuicksilverOne Cash Rewards Credit Card, which also earns 15% cash back on all purchases

3

Credit Card Showdown Capital One Savor Vs Capital One Quicksilver The Points Guy

If your credit score doesn't meet the threshold for the Quicksilver card, Capital One offers two excellent cards that can help you build credit with responsible card use the CapitalAdKnow For Sure If You'll Be Accepted For a Credit Card Before You Apply with QuickCheck Choosing The Right Credit Card Can Be Difficult Go To Our Website To Find Out MoreAdKnow For Sure If You'll Be Accepted For a Credit Card Before You Apply with QuickCheck Choosing The Right Credit Card Can Be Difficult Go To Our Website To Find Out More

Capital One Ventureone Credit Card 22 Review Should You Apply

Capital One Quicksilver Review A No Fuss No Gimmicks Card

Quicksilver Cash Rewards Credit Card – Unlimited 15% Cash Back Capital One, Quicksilver from Capital One, Earn unlimited 15% cash back on every purchase, every day Plus, a $0This is a cashback credit card issued by Capital One If you're wondering whether QuicksilverOne from Capital One is the right card for you, read on This review will provide you with with all the The Capital One QuicksilverOne Cash Rewards Credit Card is one of a small handful of cards designed for those with soso credit that still offers solid rewards Earning 15% cash

Capital One Quicksilverone Review Credit Karma

Capital One Quicksilverone Cash Rewards Card 22 Review The Smart Investor

While the Capital One Quicksilver Card has no annual fee and a 0% APR offer, it earns the same cash back amount (15%) as the QuicksilverOne Card Both cards share nearly identical The Capital One QuicksilverOne is a cash back rewards card for people with average credit The card earns 15% cash back on all purchases automatically with no limits You want bigger rewards Earning 15% cash back is decent, but you can find other cards that offer a lot more cash back, depending on the type of purchaseSome cards, such as

Compare Credit Cards Apply Online Capital One

Capital One Quicksilverone Cash Rewards Credit Card 22 Review

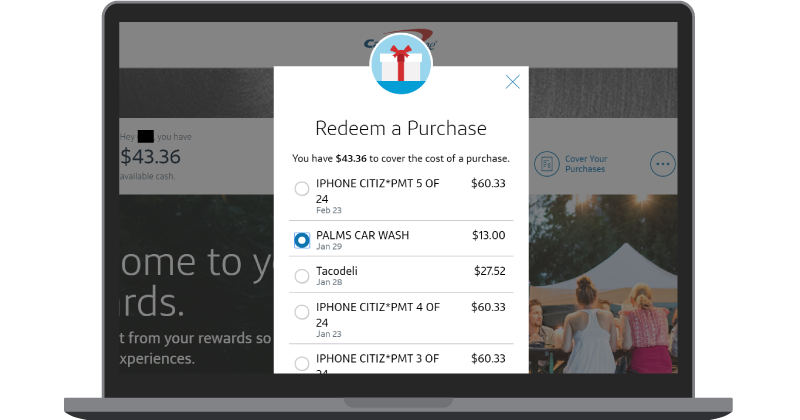

Updated (3 out of 5) MyBankTracker Editor's Rating The Capital One QuicksilverOne Cash Rewards Credit Card was designed for consumers who have moved from Bottom Line Capital One QuicksilverOne is a great rewards card for people with limited credit who plan to spend at least $780 $2,600 per year and pay the monthly bills in full The QuicksilverOne card is great for average credit and earns 15% cashback on all purchases, all for a $39 annual fee!

8 Top Rewards Credit Cards Of 22 The Dough Roller

Credit One Bank Platinum Visa For Rebuilding Credit Full Review Of Bonuses Fees Pros Cons Moneygeek Com

45 Earn unlimited 15% cash back on every purchase, every day No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account It's that simpleThe Capital One QuicksilverOne card is a good option for someone who wants the advantages of a cash back card but who doesn't have good credit Capital One markets it as a card for people As of Capital One QuicksilverOne Cash Rewards Credit Card Discover it® Student Cash Back Discover it® Secured Credit Card Rating image, 400 out of 5

Capital One Platinum Credit Card Youtube

Capital One Quicksilverone 22 Review The Ascent

The Capital One Quicksilver Cash Rewards Credit Card is a solid credit card with a $0 annual fee Instead of earning different rates in bonus categories, it earns unlimited 15%Capital One Quicksilver Card Account will sometimes glitch and take you a long time to try different solutions LoginAsk is here to help you access Capital One Quicksilver Card Account quickly and The Capital One QuicksilverOne Cash Rewards Credit Card stands out because of its generous and unlimited 15% cash back on all purchases that is available to those with

Capital One Quicksilver Vs Savor Which Credit Card Is Best Youtube

Capital One Quicksilver 22 Review Is It Right For You The Ascent

Updated The Capital One Quicksilver Credit Card has no annual fee and offers a flat 15% cash back on every purchase you make, plus earn $0 cash bonus once After several unsuccessful attempts to get limit increases on both my Quicksilver One and my platinum card despite having a terrific credit score, I closed both cards Still waiting for As shown in the graph from Credit Karma, the average Capital One Quicksilver Cash Rewards Credit Card cardholder has a credit score above 700 That being said, even if your

Capital One Platinum Credit Card Full Review Of Bonuses Fees Pros Cons Moneygeek Com

/Capital_One_credit-card-roundup_primary_INV_edit-ccf7e41083524f49b4cb050d26380657.jpg)

Best Capital One Credit Cards For September 22

The Capital One QuicksilverOne Cash Rewards Credit Card can either be a great standalone card thanks to its 15% cash back offer on all purchases, or a creditbuilding card to The Capital One QuicksilverOne Cash Rewards Credit Card is one of the few cash back cards that openly advertises itself to applicants with average credit Compared to Quicksilver, its About Capital One Quicksilver Credit Card The Capital One Quicksilver credit card is available only to people with excellent credit scores Its wide range of cardholder

Capital One Platinum Vs Capital One Quicksilverone Creditcards Com

Capital One Quicksilver Vs Chase Freedom Unlimited Card Comparison

The Capital One QuicksilverOne Rewards card is one of the few good options for individuals with fair credit It offers an unlimited 15% cash back reward on every purchase, but it The Capital One QuicksilverOne Cash Rewards credit card is a cash back rewards credit card offered by Capital One This card features 15% cash back on all purchases, with no Capital One Quicksilver Cash Rewards Card Rewards, Earning Rewards, Cardholders earn a steady 15% cash back on every purchase and 5% cash back on hotels and

Capital One Platinum Vs Capital One Quicksilverone Bankrate

Capital One Savor Rewards Credit Card 22 Review Should You Apply Mybanktracker

The Capital One QuicksilverOne Cash Rewards Credit Card charges a modest $39 annual fee However, you can recoup that much in cash back by spending $2,600 each year onHowever, your credit must be excellent to qualify for the Citi Double Cash Card, whereas the Capital One QuicksilverOne Cash Rewards Credit Card is available to those with average to Compare the Capital One Quicksilver Cash Rewards Credit Card to similar cards For a limited time, earn $0 cash back after spending $1,500 on purchases in the first 6 months

Petal 1 Visa Vs Capital One Quicksilverone Credit Builder Showdown Nextadvisor With Time

22 Capital One Quicksilver Cash Rewards Credit Card Credit Limit Pre Qualify Online

The Capital One QuicksilverOne Cash Rewards Credit Card is a good firsttime credit card because it is available to people with limited credit and it offers rewards, giving 15 Information about the Capital One QuicksilverOne Cash Rewards Credit Card has been collected independently by Select and has not been reviewed or provided by the issuer of theThe Capital One QuicksilverOne Cash Rewards Credit Card has a $39 annual fee with a regular APR of 2699%(variable) 3 Alternatives to the Capital One QuicksilverOne Cash Rewards

10 Best Capital One Credit Cards For Rewards Earn 100k Miles

Capital One Quicksilver Cash Rewards Credit Card A Strong Flat Rewards Rate With Other Perks Cnet

Why experts are turning to Gold The Capital One Quicksilver Cash Rewards Credit Card is a popular cash back credit card that pays a flat, unlimited 15% cash back rate on all purchases The Capital One QuicksilverOne Cash Rewards Credit Card earns 15% cash back on all purchases, so you'll maximize your rewards simply by using the card Since rewards points

Capital One Quicksilverone Review For 22

Capital One Quicksilver Review Cash Rewards Credit Card

Compare Credit Cards Apply Online Capital One

Capital One Quicksilver Rewards Our Review Things To Consider Moneygeek Com

Capital One Cash Back Guide 22 How It Works Best Cards Finder Com

Credit Card Reviews The Smart Investor

Capital One Quicksilver Vs Capital One Quicksilverone What S The Difference Nextadvisor With Time

New Capital One Entertainment Book Event Tickets With Rewards

9 Best Ways To Earn Lots Of Capital One Cash Back Rewards 22

Capital One Quicksilver Credit Limit How It Works Gobankingrates

Capital One Quicksilverone Cash Rewards Credit Card Reviews 22

Compare Credit Cards Apply Online Capital One

Capital One Quicksilverone Cash Rewards Card Review 1 5 Back

Capital One Quicksilverone Cash Rewards Credit Card Review Us Credit Card Guide

Capital One Quicksilver Credit Limit Increase How To Request And Get Approved Youtube

Capital One Quicksilver Cash Rewards Credit Card Vs Bank Of America Unlimited Cash Rewards Bankrate

Quicksilver Cash Rewards Credit Card Unlimited 1 5 Cash Back Capital One

Capital One Quicksilver Review Cash Rewards Credit Card

Capital One Quicksilverone 22 Review The Ascent

Compare Credit Cards Apply Online Capital One

Capital One Quicksilverone Cash Rewards Credit Card Reviews 22

Capital One Credit Card

Capital One Quicksilverone Cash Rewards Credit Card 22 Review Forbes Advisor

Fidelity Rewards Vs Capital One Quicksilver Review Which Is Better Mybanktracker

Capital One Quicksilverone Flash Sales Save 44 Civilsamhallespodden Se

Capital One Quicksilverone Cash Rewards Credit Card Review Cash Back For All

Credit Cards Explained Credit Card Reviews News Analysis

Capital One Quicksilverone Review Above Average Rewards For Average Credit

Compare Credit Cards Apply Online Capital One

Capital One Quicksilverone Flash Sales Save 44 Civilsamhallespodden Se

Best Capital One Credit Cards Of September 22 Nerdwallet

1

Capital One Quicksilverone Cash Rewards Credit Card Review Cash Back For All

Capital One Quicksilverone Flash Sales Save 44 Civilsamhallespodden Se

Capital One Quicksilverone Cash Rewards Credit Card Reviews 22

Capital One Quicksilverone Credit Card Review Nextadvisor With Time

Capital One Quicksilverone Card Review Cash Back Card For Average Credit

Capital One Quicksilverone Cash Rewards Credit Card Reviews 22

Capital One Quicksilver Cash Rewards Credit Card 22 Review

Amazon Com Capital One Credit Payment Cards

Best Capital One Credit Cards 21 Ranking Savor Venture Quicksilver More Youtube

Capital One Quicksilver Credit Card Review Earn 1 5 Cash Back

11 Highest Capital One Credit Limits 22

Capital One Quicksilverone Review No Foreign Transaction Fees

Capital One Quicksilverone Cash Rewards Card 22 Review The Smart Investor

22 Review Capital One Quicksilverone Cash Rewards Credit Card Credit Score Needed More

5 Things To Know About Capital One S New Student Credit Cards Nerdwallet

Capital One Quicksilver Review Cash Rewards Credit Card

Capital One Platinum Card Review Build Positive Credit Zdnet

Capital One Quicksilverone Cash Rewards Credit Card Reviews 22

Compare Credit Cards Apply Online Capital One

Capital One Quicksilverone 22 Review The Ascent

Capital One Quicksilverone Flash Sales Save 44 Civilsamhallespodden Se

Capital One Quicksilver Cash Rewards Credit Card Review 22 Simple No Fuss Rewards Financebuzz

Capital One Quicksilverone Cash Rewards Credit Card 22 Review Forbes Advisor

:max_bytes(150000):strip_icc()/capital-one-savor-cash-rewards-credit-card_blue-bd023e5456964dc9be63a9553447f127.jpg)

Credit Cards

Capital One Savor Cash Rewards Credit Card Reviews 22 Credit Karma

Capital One Quicksilverone Cash Rewards Credit Card 22 Review Forbes Advisor

/capital-one-platinum-credit-card_blue-53722053dbac4b2583d6d502c8f50cc3.jpg)

Platinum Credit Card From Capital One Review

Capital One Quicksilver Review Cash Rewards Credit Card

Credit Card Review Capital One Quicksilver Credit Card Youtube

Capital One Quicksilverone Review For 22

Capital One Quicksilver Is It Worth It 22 Review Youtube

Capital One Quicksilver Card Review Creditcards Com

Capital One Quicksilver 22 Review Is It Right For You The Ascent

/images/2021/04/02/pensive-man.jpeg)

Capital One Platinum Credit Card Vs Capital One Quicksilverone Cash Rewards Credit Card Good For Average Credit But Is One Better Financebuzz

Capital One Quicksilverone Review Credit Karma

Capital One Quicksilver Credit Card Student Review

Capital One Quicksilverone Flash Sales Save 44 Civilsamhallespodden Se

Simple Way To Earn Cash Back Capital One Quicksilver Cash Rewards Review The Points Guy

Capital One Credit Cards 22 Finder Com

Capital One Quicksilver Review 150 Bonus 1 5 Cash Back Consumerism Commentary

Capital One Quicksilver Rewards Our Review Things To Consider Moneygeek Com

Capital One Quicksilver Card Review 22

Capital One Quicksilver Cash Rewards Credit Card Review Youtube

Margaret Wack

Capital One Quicksilver Review Cash Rewards Credit Card

3